Menu

Mobile payments and eSIM: working hand in hand towards a connected future

The financial technology landscape has experienced a seismic shift in recent years. Digital payment cards, once seen as a novelty, are now ubiquitous, driven by the growing popularity of mobile wallets like Apple Wallet, Google Pay, and Samsung Pay.

As ‘tapping to pay’ reaches its tipping point in consumer adoption, so too does using eSIMs to make mobile connectivity an easier, more flexible and secure experience.

The parallel revolutions of mobile payments and digital mobile

Digital payment cards have been on an upward trajectory for years, but the pandemic was the catalyst for rapidly accelerating their adoption.

Over half the world’s population will be using digital wallets by 2025. Mobile payment transaction volumes are also skyrocketing, with a total value projected to reach US$11.53tn in 2024.

Digital mobile, made possible by eSIM technology, is growing equally fast. Consumer awareness has risen as a result of major smartphone manufacturers Apple, Samsung, Google, etc.) incorporating eSIM functionality into their flagship devices.

According to the GSMA, this amounted to 140 million eSIM-enabled devices in use globally by the end of 2021, surging to 2 billion by next year (2025). ABI Research estimates over half of all smartphone shipments globally will be eSIM-compatible by 2027.

Sharing experiences, forming habits and never going back

Digital mobile is perhaps a year or so behind mobile payments in terms of mass consumer adoption, so it’s fascinating to see the same factors at play.

Strongest amongst these is simply word of mouth and the act of watching other consumers using the technology.

Early adopters of mobile payments were initially unsure how easy it would be, or whether they could trust devices rather than their familiar plastic credit cards. Split a restaurant bill with friends when you’re the only one still using plastic, and you feel – unnecessarily – like the odd one out.

We’re seeing something very similar with eSIMs as friends and family learn from one another’s experiences. For instance, traveling abroad and finding you’re the only one panicking about Wi-Fi connections or desperately looking for a local SIM card shop – when everyone else is enjoying the convenience and affordability of a travel eSIM.

Key factors in eSIM adoption

One of the key drivers of eSIM adoption is the growing number of mobile network operators (MNOs) supporting the technology. eSIM Go partners with over 1,000 MNOs across more than 190 countries. This is critical in enabling consumers to take full advantage of eSIM's unique capabilities, like switching between carriers without needing to physically swap SIM cards.

Another factor contributing to eSIM’s rise is the increasing demand for multi-device connectivity. As more consumers own multiple devices — smartphones, tablets, smartwatches, etc. — eSIM provides a seamless way to manage connectivity across all these gadgets.

There’s also the shift towards more streamlined devices, 5G network capability and consumer demand for increased flexibility and choice.

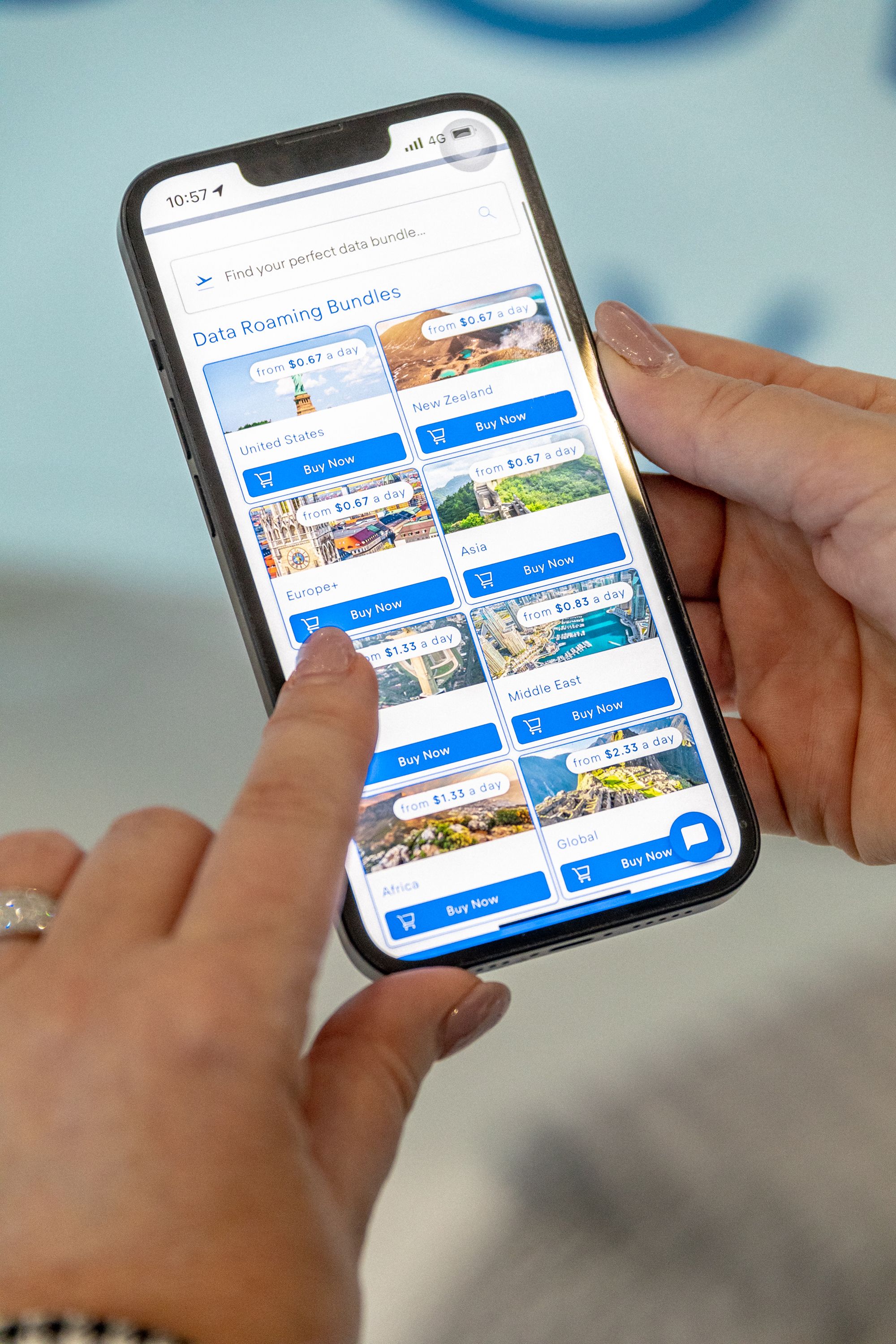

One area that’s already seen significant growth is in the travel industry. With eSIM, travelers can easily switch to local carriers in different countries without the hassle of purchasing and swapping physical SIM cards.

This not only enhances the travel experience but also opens up new opportunities for digital payment providers to offer tailored services, such as travel insurance or local discounts, directly through mobile wallets.

The future of digital payment cards and eSIM connectivity

Looking ahead, the convergence of digital payment cards and eSIM technology promises to redefine the consumer experience. As digital wallets become more sophisticated, integrating features like loyalty programs, digital IDs, and transit passes, the convenience factor will drive even greater adoption. Meanwhile, eSIM will offer the flexibility needed to support an increasingly connected world.

eSIM Go is already partnering with leading brands like Western Union to provide customers with easy access to wallet friendly data roaming, not to mention essential banking services.

The integration of eSIM into more devices will also pave the way for even more innovative payment solutions. It’s entirely possible that in the very near future consumers’ smartwatches, equipped with eSIMs and linked to their digital wallets, will handle all their financial transactions without the need for a smartphone. This level of convenience would quickly make digital payments even more ingrained in daily lives.

As we move toward this connected, cashless future, businesses and consumers alike will need to adapt to these new technologies.

For consumers, this means embracing the convenience and flexibility that digital payment cards and eSIMs offer. For businesses, it means staying ahead of the curve by integrating these technologies into their products and services.

In the end, the convergence of digital payment cards and eSIM will not only simplify our lives but also open up new possibilities for how we interact with the digital world.

The future is connected. Are you ready to make the leap? Contact us today to discuss eSIM opportunities for your business.